Portfolio characteristics

Total property value (including discounted cash flows of leaseholds obligations) of € 1,012 million (18 assets, 264,530 m²) at year-end 2019

All investments in core regions: Amsterdam, Rotterdam, The Hague and Utrecht

Total fund return of 20.3%, income return of 2.3%

Occupancy rate of 90.0%

66% of multi-tenant assets

GRESB 5-star rating (93 points)

100% BREEAM-NL-labelled assets (50% VERY GOOD)

75.5% green label (A, B, C), 69% Energy Label A

Tenant satisfaction score of 7.0

Core region policy

To identify the most attractive municipalities for investments in office real estate, the Fund takes into account the following indicators:

Characteristics of the exact location (such as proximity to public transport, accessibility by car, visibility and overall attractiveness) and the asset (such as multi-tenant, flexible and large floors, sustainability and inviting entrance area) are part of the model used to determine the risk/return profile at asset level.

The Funds’ core regions closely correlate with the urbanisation trend in the Netherlands and the ongoing shift towards a knowledge-based economy. Following the tightening of the core region policy in 2017, only Amsterdam, Rotterdam, The Hague and Utrecht are now considered core regions.

The plan is to have at least 80% of the total portfolio value invested in properties in these core regions. This currently stands at 100%. The delivery of The Garage and Move and progress on the development of Hourglass (delivered in Q1 2020), all in Amsterdam, have increased the share accounted for by the Amsterdam region to 44%. Due to two large assets in The Hague, this region still accounted for 33% of the portfolio at the end of 2019. Utrecht is still lagging, but its share will increase to around 20% following the completion of Central Park in 2021.

The Office Fund’s core regions based on market value (exclusive value of leasehold obligations)

Major segments

Multi-tenant assets

Multi-tenant exploitation can reduce the volatility of revaluations and increase the control of asset management risks, thanks to multiple lease agreements with different expiry dates and debtors. This is also in line with the diversification guideline of >70% multi-tenant assets.

A diverse office population can also enhance a building’s image as a natural, inspiring meeting place. To reinforce the dynamic character of such work and meeting spaces, it is important to offer additional (shared) facilities in the building or in its immediate vicinity. These can include catering establishments, shops, childcare facilities and other amenities, plus a range of networking spaces.

Users vary by sector, culture and nationality, but also in their requirements for office space. A flexible lay-out is essential to accommodate the workforce of a large corporate head office, as well as smaller satellite offices. Thanks to its active asset management approach, the Fund is able to respond quickly to the changing and evolving needs of its varied tenant base and changing market dynamics.

Portfolio composition by single versus multi-tenant based on market value

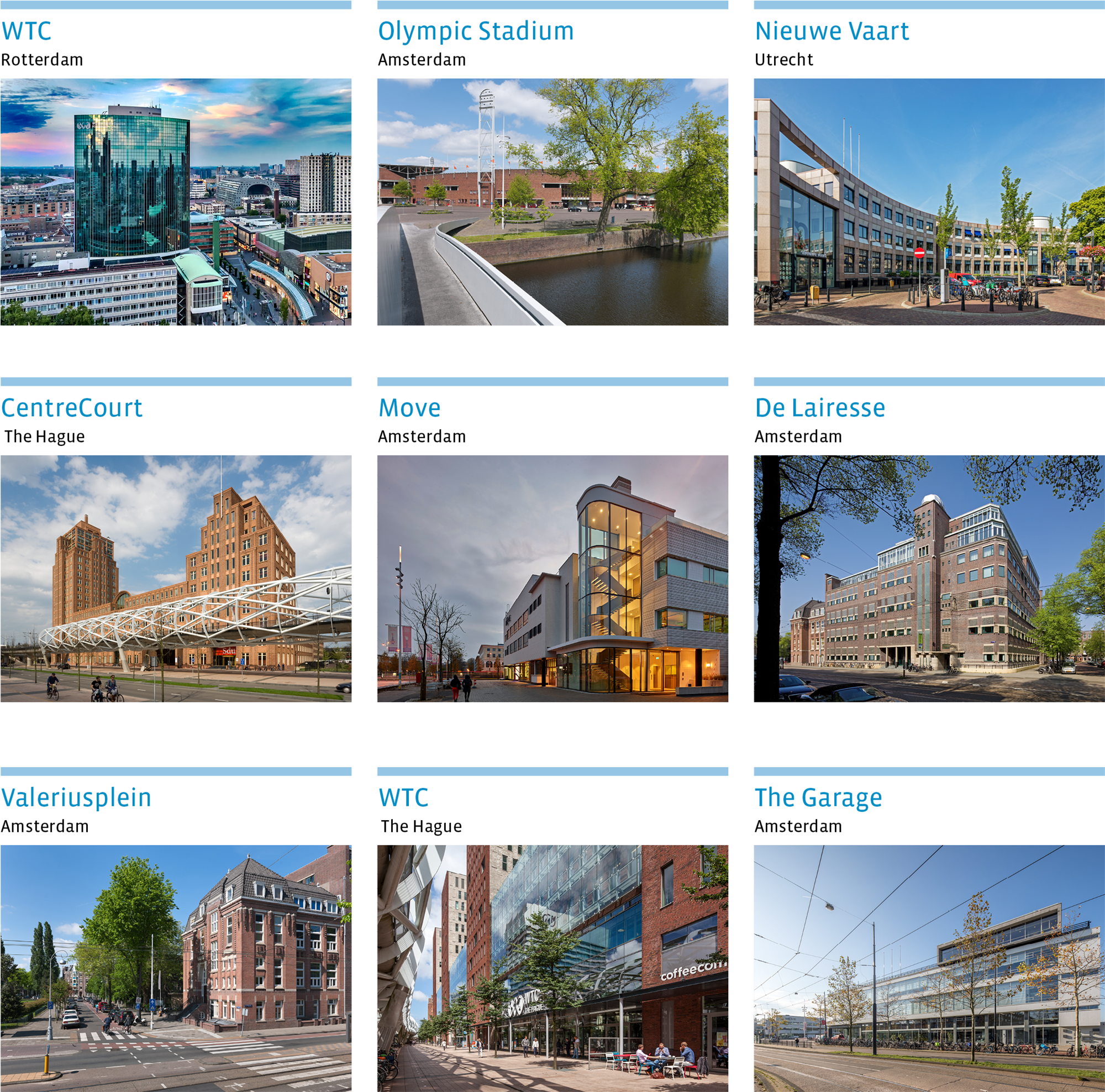

Selection of principal properties

Existing portfolio

Portfolio pipeline